Renewable energy stock investments offer a promising avenue for investors looking to align their portfolios with sustainability goals and capitalize on the growing green energy sector. In this narrative, we delve into the intricacies of renewable energy stock investments, shedding light on the benefits, risks, and strategies that define this dynamic market.

As we navigate through the key aspects of renewable energy stock investments, readers will gain valuable insights into the world of sustainable investing and the potential it holds for both financial growth and environmental impact.

Introduction to Renewable Energy Stock Investments

Renewable energy stock investments refer to investing in companies that are involved in the production and development of renewable energy sources such as solar, wind, hydro, and geothermal energy. These stocks are part of the growing sector focused on sustainable and environmentally friendly energy solutions.Investing in renewable energy stocks is significant due to the increasing global demand for clean energy solutions to combat climate change and reduce reliance on fossil fuels.

As governments and industries worldwide shift towards renewable energy sources, the potential for growth and profitability in this sector is substantial.The benefits of investing in renewable energy stocks include the opportunity to support sustainable practices, diversify investment portfolios, and potentially capitalize on the growth of the renewable energy market.

Additionally, renewable energy stocks can provide investors with long-term returns and the satisfaction of contributing to a greener future.Examples of popular renewable energy stocks include companies like NextEra Energy, Inc. (NEE), Tesla, Inc. (TSLA), and First Solar, Inc. (FSLR). These companies are leaders in renewable energy innovation and have shown strong performance in the stock market due to their focus on sustainability and clean energy technologies.

Types of Renewable Energy Sources

Renewable energy sources are crucial in the transition towards a more sustainable future. They provide clean and efficient alternatives to traditional fossil fuels, reducing greenhouse gas emissions and mitigating climate change. Here are some of the key types of renewable energy sources:

Solar Energy

Solar energy is harnessed from the sun's rays using solar panels or photovoltaic cells. It is a widely available and reliable source of renewable energy that can be utilized for both residential and commercial purposes. Solar energy contributes significantly to the renewable energy sector by providing a constant and abundant source of power.

Wind Energy

Wind energy is generated by harnessing the power of wind through wind turbines. It is a rapidly growing renewable energy source that is both cost-effective and environmentally friendly. Wind energy plays a crucial role in the renewable energy sector by providing a stable source of electricity, especially in windy regions.

Hydropower

Hydropower is derived from the energy of moving water, such as rivers or waterfalls. It is one of the oldest and most widely used sources of renewable energy. Hydropower contributes significantly to the renewable energy sector by providing a reliable and consistent source of electricity, especially in areas with abundant water resources.

Bioenergy

Bioenergy is produced from organic materials such as plants, crops, and organic waste. It can be converted into biofuels, biogas, or used directly for heating and electricity generation. Bioenergy plays a vital role in the renewable energy sector by providing a sustainable alternative to fossil fuels and reducing waste through the use of organic materials.

Geothermal Energy

Geothermal energy is derived from the heat stored beneath the Earth's surface. It is a reliable and constant source of renewable energy that can be harnessed for heating, electricity generation, and other industrial purposes. Geothermal energy contributes to the renewable energy sector by providing a stable and low-carbon source of power.

Factors to Consider Before Investing

When considering investing in renewable energy stocks, there are several key factors to take into account to make informed decisions and minimize risks.

Risks Associated with Renewable Energy Stock Investments

Investing in renewable energy stocks comes with its own set of risks that investors should be aware of. Some of the common risks include:

- Regulatory Changes: Changes in government policies and regulations can impact the profitability of renewable energy companies.

- Technological Changes: Rapid advancements in technology can make current renewable energy solutions obsolete, affecting the stock prices of companies.

- Market Volatility: The stock prices of renewable energy companies can be volatile due to various market factors.

- Competition: The competitive landscape in the renewable energy sector can impact the market share and profitability of companies.

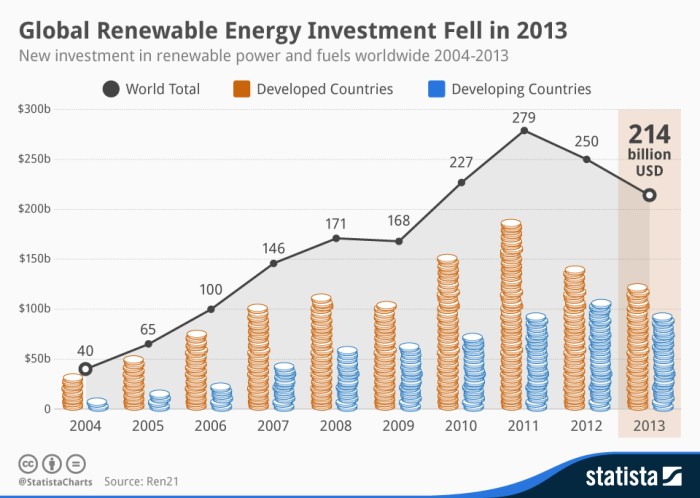

Market Trends Impacting Renewable Energy Investments

Market trends play a crucial role in shaping the investment landscape for renewable energy stocks. Some of the ways market trends can impact renewable energy investments include:

- Government Incentives: Government policies and incentives can drive investments in renewable energy, impacting stock prices.

- Public Perception: Increasing awareness and demand for clean energy solutions can positively influence the stock prices of renewable energy companies.

- Global Events: Events such as climate change summits or natural disasters can impact the market sentiment towards renewable energy investments.

- Technological Advancements: Innovations in renewable energy technologies can drive growth and profitability in the sector, affecting stock prices.

Investment Strategies in Renewable Energy Stocks

Investing in renewable energy stocks requires careful consideration of different strategies to maximize returns and manage risk. Whether you prefer a long-term or short-term approach, diversifying your portfolio with renewable energy stocks can offer stability and growth potential.

Long-Term vs. Short-Term Investment Approaches

When it comes to investing in renewable energy stocks, you can choose between long-term and short-term investment approaches based on your financial goals and risk tolerance.

- Long-Term: Investing in renewable energy stocks for the long term involves holding onto your investments for an extended period, typically five years or more. This approach allows you to benefit from the potential growth of the renewable energy sector over time.

- Short-Term: Short-term investment in renewable energy stocks involves buying and selling stocks within a shorter timeframe, such as days, weeks, or months. This strategy requires active monitoring of market trends and may be more volatile.

Diversifying Your Portfolio with Renewable Energy Stocks

Diversification is key to reducing risk and maximizing returns in your investment portfolio. Including renewable energy stocks in your portfolio can provide exposure to a growing sector while spreading risk across different assets.

- Allocate a portion of your portfolio to renewable energy stocks to benefit from potential growth opportunities in the sector.

- Consider investing in a mix of renewable energy sources, such as solar, wind, hydro, and geothermal energy companies, to diversify your exposure within the sector.

- Monitor the performance of your renewable energy investments regularly and adjust your portfolio allocation as needed to maintain a balanced and diversified portfolio.

Sustainable Development Goals and Renewable Energy Investments

Investing in renewable energy stocks plays a crucial role in aligning with sustainable development goals by promoting environmentally friendly practices, reducing carbon emissions, and fostering a cleaner and greener future for generations to come.

Role of Renewable Energy in Combating Climate Change

Renewable energy sources such as solar, wind, hydro, and geothermal power offer a sustainable alternative to fossil fuels, which are the primary contributors to greenhouse gas emissions. By investing in renewable energy stocks, individuals and organizations can support the transition to cleaner energy sources, ultimately helping combat climate change and its harmful effects on the planet.

- Renewable energy investments lead to a significant reduction in carbon emissions, helping to mitigate the impact of climate change on a global scale.

- By promoting the use of renewable energy technologies, investors contribute to the development of innovative solutions that address environmental challenges and promote sustainability.

- Renewable energy projects create new job opportunities and stimulate economic growth while reducing reliance on fossil fuels and promoting energy independence.

Positive Impact of Investing in Renewable Energy Stocks

Investing in renewable energy stocks not only offers financial returns but also contributes to the preservation of the environment and the achievement of sustainable development goals.

- Renewable energy investments support the transition to a low-carbon economy, reducing greenhouse gas emissions and promoting environmental sustainability.

- By investing in renewable energy companies, individuals and institutions can drive innovation in clean energy technologies and contribute to the advancement of a more sustainable future.

- Renewable energy investments have the potential to create a positive impact on local communities by providing clean energy solutions, improving air quality, and fostering a healthier environment for all.

Final Conclusion

In conclusion, renewable energy stock investments present a compelling opportunity for investors seeking to support clean energy initiatives while diversifying their portfolios. By understanding the nuances of this evolving market, individuals can make informed decisions that not only drive financial returns but also contribute to a more sustainable future.

FAQ Insights

What are the key benefits of investing in renewable energy stocks?

Investing in renewable energy stocks can offer long-term growth potential, diversification benefits, and the satisfaction of supporting environmentally friendly initiatives.

What risks should investors consider before investing in renewable energy stocks?

Some risks to consider include regulatory changes, technological advancements impacting profitability, and market volatility affecting stock prices.

How do market trends influence investments in renewable energy stocks?

Market trends such as government policies, shifts in consumer preferences, and advancements in renewable energy technologies can significantly impact the performance of renewable energy stocks.